BUSINESS

Drive Today: $500 Down Cars Near You

Drive Today: $500 Down Cars Near You

Financing a used vehicle with just a $500 down payment can be a game-changer, especially if your credit score isn’t perfect. With buy-here-pay-here dealerships, flexible payment structures, and in-house auto financing, you can skip months of saving and drive off the lot today—no matter where you’re located.

Why $500 Down is a Smart Start

Even a modest down payment of $500 demonstrates commitment and lowers your loan-to-value ratio, boosting approval chances. It signals affordability and reduces your principal, meaning lower monthly payments—ideal for first-time car buyers or those rebuilding credit. According to Investopedia, putting more down can help secure better interest rates and prevent negative equity.

The Buy‑Here‑Pay‑Here Advantage

Buy-here-pay-here (BHPH) lots finance and sell vehicles internally, bypassing credit checks and external lenders. This setup means quicker approvals, customizable payment plans (weekly or biweekly), and often immediate ownership transfer once the down payment is made .

How it Works: The Process

-

Choose a lot in your area that advertises $500 down.

-

Select your ride—typically a pre-owned vehicle with manageable mileage.

-

Provide proof of income and identity, not your credit score.

-

Pay the $500 down payment, which secures the car and initiates the loan.

-

Set up a payment schedule that aligns with your cash flow.

-

Drive home confidently, as ownership begins immediately if terms are met.

Pros & Cons of $500 Down Deals

Advantages:

-

Accessible financing without a high initial outlay

-

Fast approvals and same-day drives

-

A chance to build or rebuild credit—if payments are reported

-

Vehicles with decent reliability, if the dealership maintains stock properly

Drawbacks:

-

Higher interest rates due to lender risk

-

Limited selection—older models with higher mileage only

-

Rapid repossession risk if payments are missed

-

Possible non-reporting of payments (ask beforehand)

Real‑World Tips: Maximize Your Deal

-

Negotiate the “out-the-door” price—covering the full cost including fees—as CarEdge experts recommend.

-

Arrange a co-signer if possible, to access better rates and terms.

-

Consider a trade-in to reduce upfront payment—many dealerships allow you to apply it against your down payment.

-

Ask if payments are reported to build credit; some dealerships don’t report but many do .

-

Inspect vehicles thoroughly, ideally with a mechanic, as older pre-owned cars may need repairs later on

Embedded Videos for In‑Depth Insight

-

Understanding Buy‑Here‑Pay‑Here

Buy‑Here‑Pay‑Here Explained: How It Works for $500 Down Buyers -

Negotiating Out‑the‑Door Price

Negotiate OTD Price Like a Pro: CarEdge Tips -

Saving with Low Down Payments

Should You Put $500 Down? Pros & Cons Guide

Financing Alternatives Beyond BHPH

If you’d prefer a more traditional route, consider:

-

Credit unions or subprime auto lenders – may offer better interest rates and report payments.

-

Pre‑approval from banks – strengthens negotiating power at any dealership

-

Personal loans or co-signers – can also reduce financing costs and expand your vehicle choices.

Key Considerations Before Driving Off

-

Calculate Total Cost of Ownership (TCO)—include insurance, maintenance, fuel, and registration. Industry rule-of-thumb: total car expenses shouldn’t exceed 15–20% of your take-home pay

-

Set a sustainable budget—aim to keep monthly payments under 10% of your income .

-

Protect yourself legally—always get a written contract detailing interest rate, payment schedule, and title terms.

FAQs

Q: Can I buy a car with $500 down and no credit?

A: Yes—BHPH dealerships often allow this with proof of income and ID, bypassing credit checks

Q: Will my payments improve my credit score?

A: Only if the dealership reports to credit bureaus. Always ask upfront and confirm documentation.

Q: What’s the danger of buying from a BHPH lot?

A: Risks include higher interest rates, quick repossession, and older vehicle conditions. Negotiate smartly and inspect carefully.

Q: How do I negotiate better terms?

A: Focus on the out-the-door price, arrange pre-approval, trade-in your old car, or bring in a co-signer

Q: Are $500 down deals nationwide?

A: Yes—many dealerships participate. Sites like 500down.co maintain extensive databases listing local offers

Conclusion

A $500 down payment can make vehicle ownership achievable today—without perfect credit. By working with buy-here-pay-here dealerships, negotiating the out-the-door price, exploring trade-ins, and considering co-signers, you can access reliable used cars and manageable financing.

Always protect yourself: inspect the vehicle, confirm payment reporting, and calculate ownership costs to ensure long-term affordability.

BUSINESS

Innovative Checkout Solutions Transforming Retail Experiences

Introduction

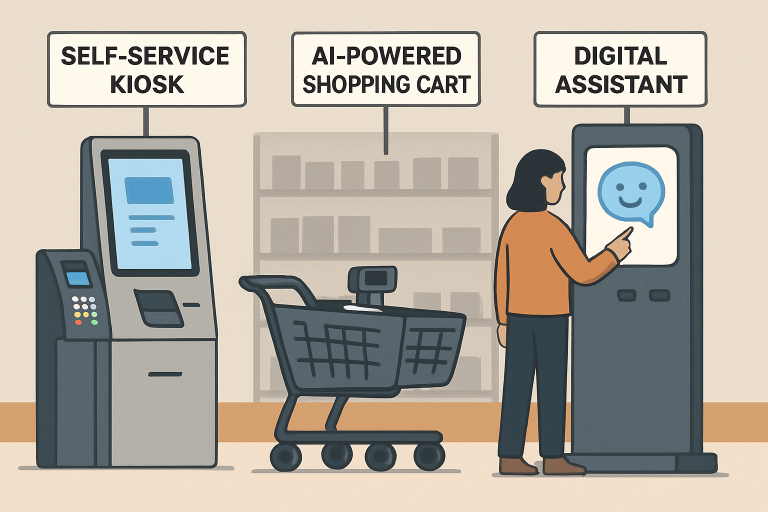

In today’s competitive retail landscape, customer expectations are higher than ever, with shoppers demanding faster service and more personalized experiences. Traditional checkout methods, while familiar, often struggle to keep pace with these evolving demands. Retailers are turning to technology-driven innovations that meet modern needs without sacrificing service quality to remain relevant. As retailers face increasing pressure to deliver seamless, efficient, and enjoyable in-store interactions, attention is rapidly focusing on reinventing the checkout process. Speed, convenience, and customer empowerment shape next-generation experiences, while advanced technology disrupts old paradigms. As a self-service kiosk becomes common in stores nationwide, businesses find new solutions to streamline checkout, reduce friction, and create environments where shoppers feel in control.

From self-service kiosks to AI-enabled carts, the drive to automate and modernize checkout enhances customer convenience and tackles operational challenges such as labor shortages and security issues. Retailers must balance efficiency with security, while ensuring that customers—regardless of their technological literacy—feel supported. The shift toward digital, staffless, and intelligent systems redefines how customers conclude their purchasing journey in physical stores.

The Evolution of Self-Checkout Systems

Self-checkout solutions have been part of the retail landscape for decades, promising shorter lines and lower labor costs. Over time, adoption has accelerated, especially as consumers become accustomed to digital convenience and contactless transactions. Yet, the proliferation of self-checkouts has exposed flaws, chief among them, heightened theft and customer frustration with glitches, slow interfaces, or complex item codes.

Retailers such as Walmart and Target are actively reevaluating their self-checkout approaches. Some have rolled back these systems in high-shrink locations after discovering alarming losses and customer complaints. According to an Associated Press report, certain major chains have seen theft rates under self-checkout systems nearly double compared to staffed lanes, sparking a renewed focus on loss prevention and customer service training.

The Rise of Cashierless Stores

Cashierless stores have emerged as the boldest step forward in pursuing ultra-convenient retail. Using technologies such as computer vision, shelf sensors, and AI, these stores enable shoppers to ‘grab and go’ without stopping at a traditional checkout. Amazon’s “Just Walk Out” pilot, now adopted across select U.S. grocery and convenience locations, exemplifies this approach. Shoppers enter, retrieve items, and leave, while their accounts are seamlessly charged in the background.

Despite initial excitement, the model presents its operational hurdles. Implementation is costly, and false positive theft alerts and technical hiccups have caused growing pains. Retailers must weigh the appeal of staffless convenience against technical complexity and customer reassurance, learning from high-profile setbacks as they refine these systems. Coverage by the Financial Times highlights ongoing debates about shoplifting risk and the current limitations of AI-driven security.

AI-Powered Shopping Carts

Smart shopping carts bring technology directly to the consumer’s fingertips. Outfitted with sensors, weight scales, touch screens, and payment modules, these carts instantaneously tally products as shoppers add them, display running totals, and support card or digital wallet payments. For retailers, these devices can drive basket size by suggesting upsells and streamline inventory insight in real time.

Leading grocery chains such as Kroger have piloted systems like Caper Cart and others, reducing time in checkout lines and delighting tech-savvy customers. Smart carts minimize friction and improve personalization and accessibility. Industry analysis by CNN Business indicates that these technological leaps could soon be a common sight as cost-effectiveness and shopper familiarity improve.

Digital Assistants in Retail

In-store digital assistants—whether app-based or physical kiosks—offer personalized customer service on demand. These assistants handle various tasks, from product recommendations and wayfinding to pre-ordering and facilitating payments. Some operate as conversational chatbots, while others guide consumers through interactive touchscreens.

Studies show that digital assistants can significantly boost satisfaction and operational efficiency. By automating routine queries and guiding customers based on their preferences, these tools free up staff for more complex or sensitive interactions, creating a more supportive retail environment. This review on digital assistants in point-of-sale environments provides further insights.

Balancing Technology and Human Touch

Retailers have learned the hard way that innovation alone doesn’t guarantee satisfaction. While many shoppers relish speedy, autonomous shopping, a substantial segment still values human interaction. Recognizing this, leading brands are reintroducing staffed checkouts and hybrid models—empowering customers to choose between tech-driven convenience and personalized service. International retailer Itsu, for example, has refined its self-service approach after observing that retaining staff for complex needs delivers higher satisfaction and loyalty.

Retailer stories on sites like the Financial Times, where many brands highlight the need for balanced automation to drive optimal business results, support the wisdom of blending automated systems with a visible, engaged staff presence.

Conclusion

Retail checkout is undergoing a transformative shift, merging AI, advanced sensors, and human expertise to create a smoother, more personalized customer experience. As the industry moves toward frictionless transactions, tools like self-service kiosks, smart shopping carts, and AI-powered digital assistants are becoming key elements of retail strategy. These technologies aim to reduce wait times, improve efficiency, and deliver tailored recommendations, enhancing convenience for modern shoppers. However, the retailers best positioned for long-term success will balance innovation with adaptability, offering technology-driven efficiency while maintaining meaningful human interaction. Rather than replacing personal service, the focus will be on integrating solutions that enrich everyday lifestyles, foster trust, and keep customers engaged. By blending cutting-edge tools with attentive support, retailers can meet evolving expectations without losing the warmth and connection central to the shopping experience.

BUSINESS

What Makes a Great Real Estate Advisor

Introduction

Finding the ideal real estate advisor can make a profound difference in your real estate journey, whether buying, selling, or investing. A genuinely great advisor is more than just a transaction facilitator; they serve as a strategic partner, guiding you expertly through every process step. For those looking for local expertise, working with a Fort Collins, CO, real estate advisor, Davis Van Tilburg, ensures you benefit from someone deeply knowledgeable about the market and committed to your success.

Excellent advisors combine industry insight, strong communication, and a client-focused approach to deliver remarkable results. By seeking an advisor who exemplifies these qualities, you can confidently navigate the complexities of the real estate world, secure advantageous deals, and ultimately achieve your property goals.

In-Depth Market Knowledge

A successful advisor is intimately familiar with local market trends, property valuations, inventory shifts, and the community’s unique characteristics. They offer clients accurate, relevant information backed by current data—helping buyers and sellers make educated decisions. This expertise extends beyond residential sales and purchases; it includes insights into commercial properties, investment opportunities, and changing regulatory landscapes, all necessary for sound guidance in a changing industry.

Exceptional Communication and Interpersonal Skills

The foundation of a standout real estate advisor is their ability to communicate clearly and build meaningful relationships. Active listening allows advisors to fully understand their clients’ needs, while effective verbal and written communication ensures critical details are discussed and documented. Skilled advisors also recognize non-verbal cues, helping to address concerns clients may not have voiced. This level of attentiveness and openness is vital for establishing trust and keeping clients well-informed throughout their journey.

Strong Negotiation Skills

Negotiation plays a leading role in real estate success. An expert advisor brings strong negotiation tactics to the table, advocating fiercely for their client’s interests. This means understanding the motivations of every party, aligning terms to create win-win scenarios, and knowing when to stand firm or offer flexibility. The best negotiators rely on experience, preparation, and an ability to read each situation, ultimately improving outcomes for their clients on both sides of the transaction.

Professionalism and Ethical Practices

Trust is non-negotiable in real estate. Advisors who adhere to high ethical standards—acting with integrity, transparency, and consistency—earn the confidence of their clients. Professionalism sets great advisors apart, whether through honest disclosures, clear communication about commissions and fees, or strict confidentiality with personal information. Upholding strong ethics protects clients and safeguards the advisor’s reputation within the industry.

Technological Proficiency

Modern real estate is intertwined with technology. Great advisors utilize virtual tours, online marketing, digital contracts, and CRM systems to enhance service delivery. Embracing these innovations allows advisors to present listings appealingly, respond quickly to client inquiries, and manage transactions more efficiently. A tech-savvy approach also expands reach across social platforms and online networks, amplifying exposure for clients’ properties and attracting more prospective buyers and sellers.

Effective Networking Abilities

Exceptional advisors continually broaden and strengthen their professional networks. Collaboration with other real estate agents, mortgage lenders, inspectors, and legal experts means clients enjoy a streamlined, comprehensive experience. Networking isn’t just about connections, but about maintaining relationships that yield valuable referrals, market insights, and problem-solving resources for every client scenario.

Adaptability and Continuous Learning

The real estate market is dynamic and constantly evolving. Advisors who stay ahead of the curve adapt seamlessly to new regulations, emerging technologies, and shifting buyer and seller expectations. Their commitment to professional development—through certifications, seminars, and industry updates—ensures they always offer informed, innovative guidance catered to the latest market conditions.

Client-Centric Approach

The hallmark of any outstanding real estate advisor is an unwavering commitment to their clients. Advisors who prioritize understanding each client’s vision, goals, and concerns provide tailored advice and support. This means proactively answering questions, offering transparency at every stage, and remaining accessible long after closing. A client-focused advisor fosters loyalty and generates referrals by consistently exceeding expectations and creating a positive, lasting impact.

Choosing the right real estate advisor can be one of the most critical decisions in your property journey. By focusing on these key qualities—communication, expertise, negotiation prowess, ethics, technology, networking, adaptability, and unwavering client care—you can confidently trust the right advisor and experience a truly successful real estate transaction.

BUSINESS

Rising Barriers: Japan Tariffs Shifts Explained

Rising Barriers: Japan Tariffs Shifts Explained

In recent months, Japan tariffs have taken center stage in trade discussions, as the U.S. government implemented sweeping reciprocal duties on automobiles, metals, and a universal base tariff on imports. This major shift in trade policy has reverberated across global supply chains, impacting everything from auto manufacturing to logistics strategies in Tokyo and beyond.

Background: The Trigger for Tariff Hikes

The U.S. rolled out a universal 10% tariff on imports effective April 2025, followed by country-specific duties—most notably a 25% tariff on Japanese cars and a 24% levy on other exports. As global markets absorbed the shock, concerns emerged regarding compliance with WTO rules and the broader implications of protectionism .

Japan’s Prime Minister Shigeru Ishiba, along with Trade Minister Yoji Muto and negotiator Ryosei Akazawa, swiftly engaged Washington, urging carve-outs for autos and steel while launching a U.S. Tariff Response Headquarters domestically.

The Impact on Autos & Heavy Industry

The most immediate effect manifests in Japan’s automobile sector, which accounts for roughly 28% of exports to America. Economic analysts estimate the 25% auto tariff could slice up to 0.8% off Japan’s GDP, drive production shifts abroad, and depress domestic wages.

Supply Chains & Logistics Transformation

Beyond tariffs, the policy has triggered a logistics overhaul. Japanese manufacturers have shifted from just-in-time to just-in-case inventory models, leading to a 60–105% jump in parts warehousing. This burgeoning demand is reshaping the domestic logistics real estate landscape, creating space for growth despite trade headwinds.

Market Moves & Currency Impacts

Financial markets shrugged initially, but volatility followed. The Nikkei stock index plunged up to 7.8% after the tariff announcement. Meanwhile, the yen weakened, reacting to global risk assessments and trade uncertainties.

Geopolitical and Trade Relations

These tariff moves have strained the U.S.–Japan alliance, prompting fears that trade friction could undermine strategic cooperation—especially around China and regional security.Japan is now exploring alternative economic partnerships, including deeper engagement with the CPTPP and EU trade frameworks.

Visual Highlights

Strategic Responses in Japan

-

Diplomatic Negotiations

Japan continues to press for tariff exemptions—especially on autos—through formal talks and WTO oversight -

Domestic Risk Mitigation

METI’s tariff office offers targeted financial and advisory support, while the government explores energy policy shifts like nuclear restarts to improve trade balance -

Supply Chain Redesign

Major brands are reallocating production investment to North America, erecting warehouses, and revising logistics strategies to dampen tariff risk.

FAQs

Q1: What are Japan’s core exports hit by these tariffs?

Most affected are automobiles (25% duty on U.S.-bound vehicles), plus steel, electronics, and specialty chemicals.

Q2: How much could Japan’s economy suffer?

Analysts expect a GDP hit between 0.6% and 0.8%, with downstream effects on wages and domestic demand.

Q3: Is there a U.S.–Japan trade deal mitigating tariffs?

Negotiations are ongoing but no exemptions have been granted yet. Japan is pushing for tariff carve-outs as talks continue.

Q4: How are supply chains evolving due to tariffs?

Shift to buffer stock strategies (“just-in-case”), multi-location production adjustments, and investment in logistics real estate are now widespread.

Q5: Could tariffs harm U.S.–Japan strategic ties?

Trade frictions risk spilling into security cooperation, prompting Japan to diversify alliances and deepen regional integration.

Conclusion

Rising Barriers: Japan Tariffs Shifts Explained traces the complex fallout from the recent surge in U.S. tariffs on Japanese goods. These measures have rattled export-heavy sectors such as autos, triggered structural supply chain shifts, and stirred geopolitical tension. Yet Japan is responding proactively—through diplomatic outreach, domestic support systems, energy shifts, and strategic logistics expansion.

In this evolving environment, the resilience and adaptability of Japanese industry and policymakers will be key. Watch for breakthroughs in trade negotiations, changes in American tariff policy, and how Japan pivots toward global trade platforms like the CPTPP and EU deals to safeguard its economic sovereignty.

-

HEALTH7 months ago

HEALTH7 months agoPure Clarity: The Power of Saline Contact Solution

-

GENERAL9 months ago

GENERAL9 months agoUnveiling the 322 Messianic Prophecies: A Deep Dive

-

FASHION9 months ago

FASHION9 months agoDebonair blog:The Art of Stylish Living

-

TECHNOLOGY9 months ago

TECHNOLOGY9 months agoWhat happened to spank bang

-

ENTERTAINMENT9 months ago

ENTERTAINMENT9 months agoWhat Is JerkMate? Exploring the Features and Purpose

-

FASHION9 months ago

FASHION9 months agoUnderstanding the Carmelita Neck: A Unique Fashion Detail

-

BUSINESS9 months ago

BUSINESS9 months agoCrypto FintechZoom: Navigating the Future of Digital Finance

-

ENTERTAINMENT9 months ago

ENTERTAINMENT9 months agoDrake Exposed: The Untold Truth Behind the Music and Fame